Most Crypto Projects are a Scam

If you've seen much of twitter at all, you will know pretty quickly I don't like cryptocurrencies.

To be clear, I don't hate the technology behind cryptocurrencies. Cryptography is an extremely useful bit of maths that enables a lot of what we do on the internet long before the term "cryptocurrency" was common place. Distributed databases are an interesting problem. Decentralized systems have fascinating technical architecture.

I do however, declaring my bias, have a huge chip on my shoulder when it comes to the social impact of how cryptocurrencies have been used and their impact on the world. Lets have a quick look at the score card.

I am not a financial advisor. None of the information in this post should be taken as financial advice. not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this blog.

What it costs:

- Massive energy consumption

- $100Ms lost in scams

- Brain drain of good software engineers

What it provides

- public, decentralized, cryptographically secure database entries

- Massive enrichment for a small group of people

On the technology side, it is an interesting architecture. Like other distributed technologies like BitTorrent, anyone can run mining or servers that participate in the backend of the whole system. Topics in this post have been covered in the past, but using this as a post to cover what I think are some of the important aspects of crypto, and trying to avoid the hype and noise.

# Massive energy consumption

When most people think of "crypto", they think of BitCoin, Ethereum and maybe a few others which are heavily and constantly pumped both in traditional and social media. Nearly all the popular crypto uses a method of validation for transactions called "Proof of Work" (opens new window). That is, a computer plays a guessing game to see if they guess the right value first and provides the answer to the rest of the network. The answer is validated by other miners in the network, and the whole process repeats every short interval, for example 10 minutes for Bitcoin, or 15 seconds for Ethereum.

TL;DR; Bitcoin uses about the same amount of energy as Thailand, Ethereum about the same, combined they use close to the energy of the UK. Sucking up cheap renewable energy and leaving a mountain of waste in their wake. Even using the most optimistic examples of mining device efficiency, the numbers are hard to grasp. See below for comparisons to everyday energy use.

# How it works

Even though the interval is short, the power (W) that it takes to run the massive clusters of dedicated computing devices (devices that generally have no other purpose but to play specific guessing games) is truly mind-boggling.

We can easily find out the hashrate of the network on various sites since this information is public (opens new window). At the time of writing, the hashrate for BTC was 159 million TH/s. If you found that number hard to parse, you are not alone. Boiling it down to just hashes per second, this is the number.

159 350 000 000 000 000 000 hashes/sec

Taking this number and being generous to the power efficiency of miners, lets assume all those hashes come from the most efficient ASIC mining device money can buy, currently the Bitmain AntMiner S19 (opens new window) at 34.21 W/TH/s. That is, for every Watt of power it draws, it can run 29.231 GH/s. That is a lot of guesses for a single Watt of power.

Using this number, we can (optimistically) estimate the BTC network power draw at:

(159.35 * 10^18) / (29.231 * 10^9) Watts or

5.451 GW

This estimate actually around four times lower than much more sophisticated estimates (opens new window) of the power requirements for the Bitcoin network, but let's be generous and use this to convert into energy (Wh) per day.

5.451 * 24

130.824 GWh per day

# Power vs Energy

Power and energy commonly get mixed up (understandably as it is a complicated topic!), so lets boil this down to some household items. The following is a list of climbing examples with their power requirements when you turn them on, combined with a common example of energy from their use.

- iPhone fast charger - 12W

- 6-10Wh of energy at full charge.

- Desktop PC - ~150-500W

- 450-1500Wh of energy in a 3 hour gaming session.

- Electric Kettle - 1000-2400W

- 50-120Wh of energy to boil the water (assuming 2-3 minutes to boil, will vary based on amount + temp of water).

Energy is the total amount of work done regardless of amount of time passed measured in Watt-hours. Power is how fast you can do that work. The higher your Watts output, the more Watt-hours of energy you will use in the 1 hour period. 1 Watt = 1 Joule per second. Same principle, but smaller units that are less useful in every measurement of power and energy.

If you live in a house with smaller electrical circuits, you might have experienced tripping a circuit when turning on a kettle or a heater. That is because these items generally draw a relatively large amount of power.

# Boiling water

How many kettles would it take to power this optimistically efficient BTC network?

5,451,000,000 / 2,400

2,271,250 Kettles

2.2M kettles constantly boiling an infinite amount of water. This is a similar amount of power that has to be handled when popular UK soap opera episodes end and everyone wants to have a cup of tea at the same time (opens new window).

Except, this isn't a 2-3 minute event that provides a whole nation hot water for their tea. It is a constant (and growing) amount of energy consumption servicing just 6 transactions a second. That single kettle uses about 120Wh of energy to boil the water. In contrast, the roughly 500,000 transactions that happen on the BTC network each day take..

130.824 GWh / 500,000

261.648 KWh per transaction

Which means you would have to turn on 2,180 kettles every time you processed a single transaction. Put another way, this is enough energy to power an average Australian home for nearly 2 weeks. For a single transaction.

# Energy costs money

As anyone who has paid their electricity bill knows, powering your home isn't free. Bitcoin has transaction fees which are given to miners. These fees, along with mining new blocks, are used as a way to reimburse/incentive miners to keep playing the guessing game. These fees are quite dynamic (opens new window). How much you put really depends on when you do it and how fast you want it transferred. At the time of writing, a transaction on the BTC network costs around $3 USD.

Here is one of the many disconnects between energy consumption, and the running of a cryptocurrency network. 261 kWh (remembering this is a very optimistic figure that is likely a 300% higher in reality) in Australia would cost around $30 USD retail, but here we are only paying 1/10th of that in fees.

Some of it is subsidised by the release of a new block, which is very valuable (6.25 BTC as on May 2020, valued at ~$380k USD at time of writing) but only 1 miner every 10 minutes receives this reward. The value of this reward is based on a declining amount of Bitcoin released in a new block as time goes on as well as the market value. The assumption being that as supply of new Bitcoin reduces, the market price will increase.

# Renewable energy is cheap

Miners, understandably, are very sensitive to power costs when it comes to running their operations. So they commonly use renewable energy as a way to reduce their ongoing costs. Renewable energy like solar and wind have become the cheapest forms of electricity generation in the world alone side hydroelectricity. In sunny countries like Australia where our population has invested heavily in "rooftop" solar, we generate ~60-70GWh on energy on a nice sunny day (opens new window). If we add in utility scale solar, it is close to 100 GWh of clean energy. Using all of Australia's solar electricity generation would still not be able to cover the most optimistically efficient BTC network's energy requirements.

So while the Bitcoin network is global, it still requires the energy of Thailand (opens new window) just to operate. It is argued that this demand spurs on more investment into renewable energy. While there is some truth to this if we look at small scale hydroelectrics in China, a lot had to be closed down due to negative environmental impact (opens new window). 4 out of 5 of the 25000 small scale hydro plants were shut down and needed to take measures to comply with government standards. Operators turned to the unregulated crypto mining to make money as they were not allowed to sell electricity to the grid.

Adding additional utility scale electricity generation to an electricity network is a complicated process that takes a lot of planning. Bitcoin sucking up cheap renewable generation, side stepping the grid, is actively prolonging fossil fuel generators and at the very least is using up uniquely suited geographical locations to pop up poorly planned hydroelectricity to reduce their own short term gains.

# Ethereum Proof of Work

You can take the numbers from above and apply the same to Ethereum as well. Their total energy consumption (opens new window) is pretty close. They are planning on moving to a Proof of Stake (opens new window) model, but this will take time, and we are yet to see the impact on their network of this change. It is predicted to fully change to Proof Of Stake by mid 2022, and if it works, it should mean at least a 1000-2000x reduction in power usage (opens new window). It will still be one of the higher Proof Of Stake models for power consumption (opens new window), and still 10-1000x less efficient than consensus models used by Stellar (opens new window) that uses roughly 25kW for the entire network. That's just 11 kettles, not millions like in Proof of Work.

I'm stuck on this point of energy consumption as in the decade of 2020s, every kilogram of CO2 released due to energy use is something as a species we desperately need to reduce. I worked over 4 years at a company on global solar radiation forecasting technology to try to help increase network penetration of solar energy in electricity networks. Seeing new industries grow to multiple countries worth of energy consumption dilutes the impact of new renewable energy generation in the grid and prolongs our reliance of "natural gas". Gas is the source of massive methane pollution which is a potent green house gas that, again, we desperately need to reduce emissions, and fast (opens new window).

# What does it achieve?

A lot of proponents of cryptocurrency like Bitcoin and Ethereum would ague it has a few big advantages to make it all worthwhile. Three of the main features of these technologies that are commonly repeated are:

- "Trustless" system

- Blockchain

- Democratized finance

Or in other words, a public, decentralized, cryptographically secure database.

These features tend to be touted as the reason for why cryptocurrency can be disconnected from governments, unlike fiat currencies. This has some truth to it as well. If you only deal in cryptocurrency as a way to trade, you can side step government backed fiat and fear of getting your investment seized. These features also attract large scale money laundering (opens new window) which while technically can avoid the use of large crypto exchanges, they are nearly always involved when converting it back to cash after being cleaned.

Legitimate problem around government seizures impacts very few people globally, but in some countries is a larger problem than others. In these countries, yes, the ability for people to create a wallet and trade without interference is a useful technology to oppressed groups of people. Anyone can create a 'wallet' (without a popular exchange), which is a long string identifying number that has a secret (immutable) key associated with that wallet. These two pieces of information make up the key pair of the public key (wallet address), and the private key (your secret to access said wallet).

Every transaction on the network is on the public ledger, which lists the amount, and the parties involved, only identified by each wallet address. Once you identify a person to a wallet address, you know the full history of transactions performed with that wallet. This is a feature most people would not want from a personal bank account. Everytime I use my crypto wallet, I would potentially expose who I am and every purchase or transaction I've ever made with that wallet. Turns out, organized crime also don't like this feature but there is a way to obfuscate your dealings. A person is likely to have multiple wallets which does assist in hiding who is doing what on the network. An industry of Bitcoin mixing services has even popped up to support those needing to cover their tracks, legitimate or otherwise.

# Trustless system, dishonest people

While the system might be "trustless" in the sense that the distributed system acts the same regardless of people involved, you shouldn't trust most people that encourage their use either. (opens new window). Ads for crypto related products, including NFTs, are growing to be such a nuisance that major advertisers have needed to adopt official (opens new window) policies (opens new window) around their use. This has stopped some 'ICO' (initial coin offering) spam that was common in 2018, but since then, 'DeFi' (Decentralized Finance) products are growing rapidly along with their related ads. We are seeing in late 2021, a large growth of even physical crypto ads (opens new window) trying the same pump and dump strategies praying on peoples Fear On Missing Out (FOMO).

Large advertisers like Google unable to resist the large amount of advertising revenue from these services, it reversed a previous ban (opens new window).

# But people have gotten rich!

It is true that people have made some immense fortunes thanks to cryptocurrency (opens new window). However, in an industry with related scams and fraud that are reported very frequently, a lot less talked about stories about people having their lives ruined (opens new window). More traditional banks are getting involved in enabling the trading of crypto in 2021, and even these articles have anecdotes of individuals turning $800 into $50,000 in mere months (opens new window), thanks to a service that are "paying 130 per cent per annum" on investments.

Looking at some basic numbers of Ethereum, which this miraculous $800 AUD to $50k AUD growth has happened over "last few months", things don't even come close to adding up, even wealth on paper.

The lowest point of Ethereum in the last 6 months was ~$1780 USD and now sits at ~$4500. If we normalize the investment to USD, and we include the 130% annual interest on top we still fall short at ~$3500 in total. This person would need to not only reinvest all interest (assuming it was paid out daily) (opens new window), but also throw in another $2500/month over 6 months or whopping $6000+/month if "a few months" was only 3 months. That is a lot of money for someone that has "never had over $800".

Investors in crypto have a personal, vested interest in convincing other people to throw their own money in as well. Everytime you hear or read these stories, do the math and ask yourself if it sounds realistic.

So while it is indeed possible to make money investing in crypto, should you? Is any value created?

# Value Creation vs Value Extraction

Value creation is a very common output of a well functioning economy. Take materials like iron, wood, brick, cement, wires and plumbing, doesn't mean you can just conjure a house. Building a house using all these materials creates value in the form of a house for someone to live. Same goes for any manufactured item around the home, your phone, computer, kettle and even the energy to power these devices.

Energy is all around us, but directing the flow of that energy to do something useful creates value where there wasn't any. We usually pay for this added value in an interchangeable medium for goods and services, aka, money/currency.

Value extraction on the other hand, takes something that already has value, does nothing with it and charges money just the same. Value extraction can be obfuscated and spread over time since as a way to be attractive giving people instant gratification.

Another way to hide value extraction is through complexity. Cryptocurrencies are anything but easy to grasp, not only because they have no physical representation, but the decentralized nature of it combined with cryptography makes it hard to put together. Combine this with constant stories of people getting rich and amount of money involved, it is easy to put aside any skepticism and see if you can get any for yourself.

# Step 1 - Energy in

Bitcoin for example isn't a process of leasing access, but it is a complex process that consumes energy and changes form. It takes energy, plays a guessing game and for that work the system ensures through use of cryptography and decentralized validation that a transaction is accurate. The public ledger updates with your transaction, and the process repeats. That's value creation right?

Well, it certainly looks like the process of value creation. If you really needed that value in a public, decentralized, cryptographically secure database entry, then technically yes, it creates value.

# Step 2 - ???

An entry in a public, decentralized, cryptographically secured database could be used for anything. We use the term 'cryptocurrency' hinting at the fact that is it like money. Complain that you can't actually buy much with this money (until you convert it back into fiat), and you will be quickly told 'It's an asset, it stores value, like gold'. Gold has a lot of applications, including being widely used in electronics. What is your public, decentralized, cryptographically secure database entry used for? You will likely get an array very hand-wavy reasons about why that entry has value.

- User autonomy

- Transactions are pseudonymous

- Transactions are irreversible

- Can function as a store of value, and a unit of exchange

- Restricted supply and increasing demand increases its value*

- Smart contracts

- Low transaction fees for international payments

The list goes on, usually describing the features of cryptocurrency. Are those features actually useful to you or do you have another reason to buy crypto?

The assumption on this investment, is that these values are useful to 'the market'. The value keeps going up, so the "invisible hand of the market" must be working? It makes sense that people want to get in on that profit!

# Step 3 - Profit

Markets aren't magical things. They are made up of decisions people make, so they are exploitable. A Ponzi scheme is a market interaction that plays on peoples greed but from the outside looks like a legitimate investment that has amazing returns... at least, until it doesn't.

As that market has investors jumping on board, new investments can be used to pay out earlier investors. One common marker that Ponzi schemes often share is they have extremely energetic and excited investors that try to convince everyone they know to invest themselves.

In the case of BitConnect, users traded their Bitcoin for Bitconnect Coin to lock in (opens new window) an exceptional daily interest rate of 1% or 365% annual rate paid out daily. The 130% annual interest rate from the previous example is a daily of around 0.35%, or just over one third. At that rate, if everything was legitimate, and the scheme lasted for 5 years, a single $5000 investment would become $3M when compounded daily. At 1% daily, it would be $62M. Stretch it out to 10 years, and you'll have $4.8 million, trillion ($4.8x10^18) dollar or about 50,000 times more than the entire global economy (opens new window). The value of crypto has to exist in the real, finite world that we all share. Just like rice on a chessboard (opens new window), reality has to kick in and tell the maths its dreaming.

This 130% example comes from Axie Infinity (opens new window). It is a platform "side chain" that is built on top of Ethereum targeting gaming. They only have 1 game for now that is heavily inspired by Pokémon where you collect creatures to battle as well as digital 'land' you can buy.

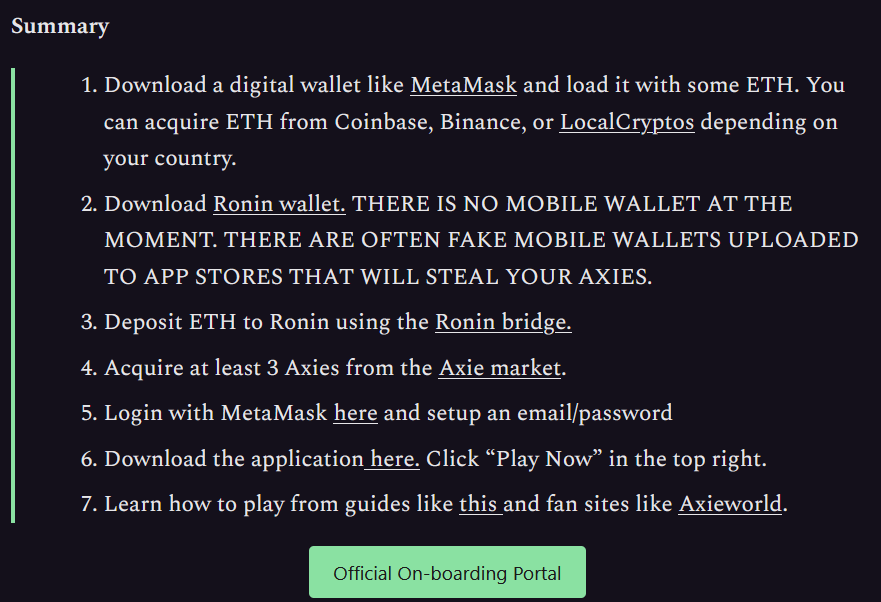

To get involved you need to buy (using Ethereum) at least 3 Axie (creatures) that generally sell for nearly $500 USD each on their marketplace. They claim they are making the process easier to onboard new players, but at the time of writing, this was the required 7 step process including spending $1500 USD before your start playing.

Ethereum "sidechains" are more efficient usually because they don't implement the same consensus algorithm, and then 'rollup' many of their transactions into a single Ethereum transaction to save on fees. They are also often closed source and actually don't store that much data on Ethereum itself considering the cost is extremely expensive (opens new window).

In just 30 days, Axie Infinity spent $6.54M USD in transaction costs (opens new window). Only references to their "Ronin" sidechain contracts stored on Ethereum, without their sidechain being online, the entries in Ethereum are meaningless.

The game from Axie Infinity isn't $1500 USD better than other existing Pokémon clones or the original, so why are 'players' using their Ethereum to get in early to play?

Greed mainly (opens new window). They care about features that impact on their investment returns (opens new window).

Below are a few comments from reddit when a new feature allowing players to avoid high Ethereum exchange fees (note, members of the public can't run validators/nodes, unlike other crypto).

- "Slp pumping. I wonder how much higher it will go"

- "OMG OMG OMG ALL MY SAVED SLP IS NOW DOUBLED! OMGGGGGGGG"

- "🚀🚀🚀🚀🚀"

The game is completely secondary. Users are managing digital assets on a marketplace, pumping their assets in real life in hopes for a return.

This has similarities to both gambling, and a traditional Ponzi scheme, but the complexity of the system makes it harder to nail down. As long as the operators have service don't up and leave like other scams have done, users are playing a game of hot potato with database entries.

# Trading is a metagame

Speculation of what others will do with these crypto assets drives a lot of their price. Elon Musk tweeting about Doge shoots up the price, why? Because people jump back into DOGE hoping new blood of users will also do the same, and they can make some quick profit. DOGE didn't increase in utility, people just thought there would be more people wanting DOGE because Musk said something about it.

This is the same with sidechains emerging around NFTs. If transactions are more accessible and hyped by the right people, it is expected to attract more people expecting to make money. Traders start thinking "If they know, that I know, that they know..." when trying to determine future price changes or if they should invest, or they just YOLO and see what happens.

# Actual use cases

All of this is not the fault of the technology. If your requirements needs a public, decentralized, cryptographically secure database, then you're in luck. There are literally hundreds of running platforms to chose from.

A system where all game digital assets can be traded freely between games between individuals I agree is a legitimate use case for such a technology. However, just like popularity in games changes extremely quickly, so will the 'value' of these in game items. This can be seen in the Steam Community Market (opens new window). Valve has implemented this community market where any Steam user can participate while not being:

- Public (users can't see the buyers of sold items)

- Decentralized (users can't run community market servers, and you can't see outside Steam)

- Cryptographically secure (HTTPS yes, but key pairs between buyer/seller not used for each transaction)

Money made from items can only be used via a Steam Wallet, there is no exchange that allows users to eventually trade for fiat money which I suspect has greatly suppressed any speculation. Prices for items rarely go above $1 USD. High in demand items will generally sell for less than $2-$100 USD. This is a lot more accessible than $1500 as seen to even start playing with Axis Infinity. There are outliers trying to sell for over $2000 USD, but these appear to be people listing rare items hoping someone will be willing to spend that much money.

If a marketplace like Steam Community Market existed but instead it acted as a generic exchange, one advantage would be the freedom for developers to not need Valve/Steam as a middle-man. This might end up what groups like Axie Infinity actually offer, but with that company receiving $150M in their last funding round (opens new window), investors will want a return on that, and it has to come from somewhere...

# Web 3

This could be a whole post in itself, but in recent time there has been a lot of hype around "Web 3" which very few people seem to be able to agree on. At this stage, it looks like more VC money not knowing what to invest in (cough renewable energy solutions cough), and they want to monetize every aspect of life (opens new window).

This is just another example of value extraction.

# Conclusion

If you find yourself really needing the features of a public, decentralized, cryptographically secure database, please do your research into, efficient systems. Solutions like Stellar (XLM) or Nano (NANO) have efficient consensus based algorithms that won't cost the Earth, and very likely you'll be able to achieve a generic marketplace. On the other hand, wow you will avoid crazy speculation ruining the experience for gamers that just want to trade items I have no idea.

Full disclaimer, I received XLM during a 2014 ICO which I sold in 2018 after I forgot I had signed up. I still hold 1 XLM ($0.23) because the minimum Stellar in a wallet is 1 XLM.